The Flow network was designed from the ground up as the foundation for a new digital economy. An economy that is owned and governed by its participants.

The ethos, architecture, and token economics of the Flow network as a whole are covered in previously published documents:

The FLOW token is the native currency of the Flow network, ultimately required for the network and all the applications on top of it to function. FLOW is designed as a payment method as well as long-term reserve asset for the entire Flow economy. The token is a low-inflation asset that is used by validators, developers, and users to participate in the FLOW network and earn rewards. It is also used to transfer fees, serve as collateral for secondary tokens on Flow, to pay for storage, and to participate in future protocol governance.

In the FLOW Token Economics paper, we outline the key principles of the FLOW token: diverse use-cases, broad distribution, and minimal monetary inflation. This paper will focus exclusively on the launch of the Flow network and concurrent distribution of the FLOW token.

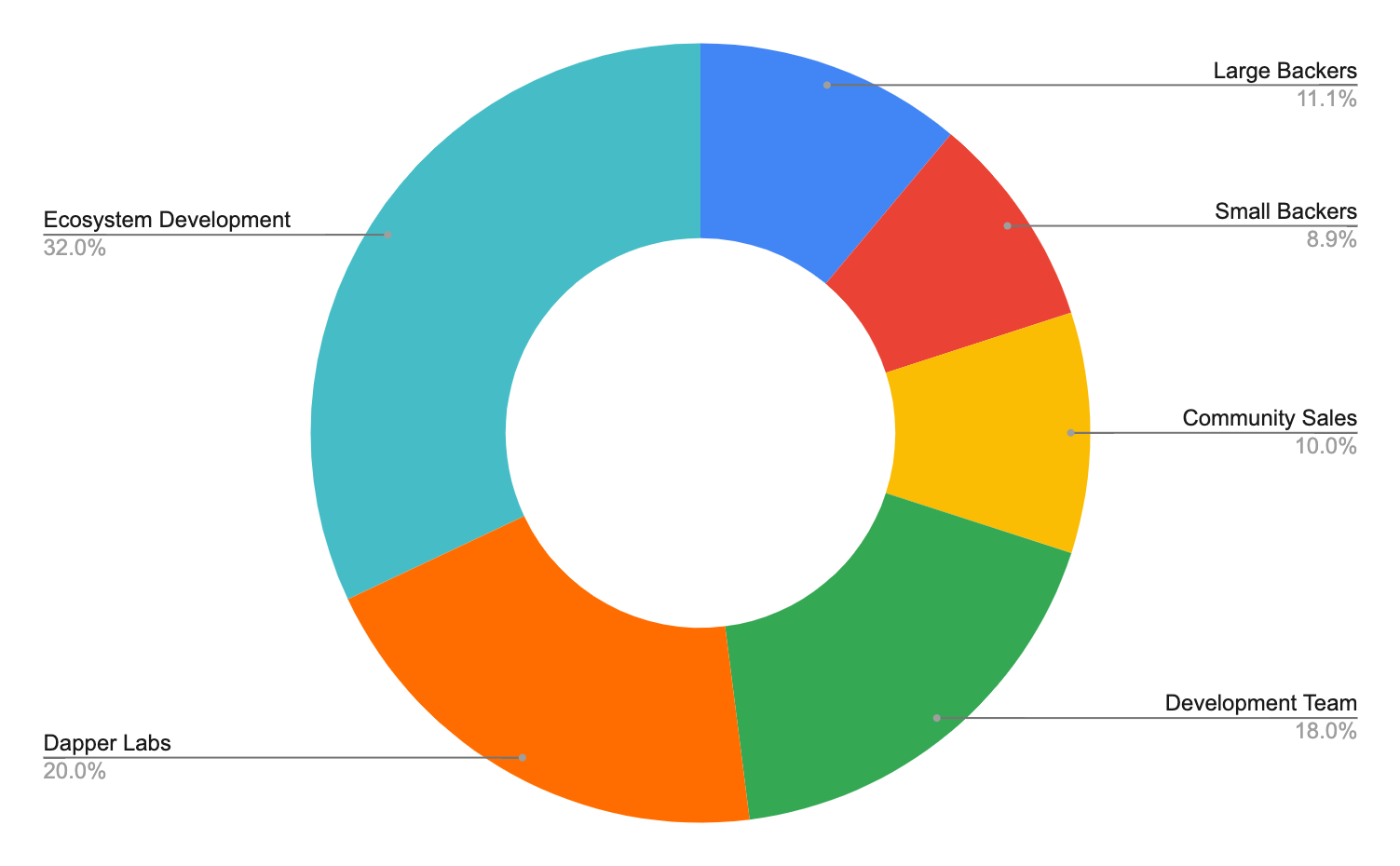

The genesis block was created in June 2020, with 1.25 billion FLOW.

For transparency, the breakdown of genesis block holders is outlined below:

Validator rewards were enabled on mainnet in December 2020.

These reward tokens are liquid for use on the network as soon as they are withdrawn by the node operator.

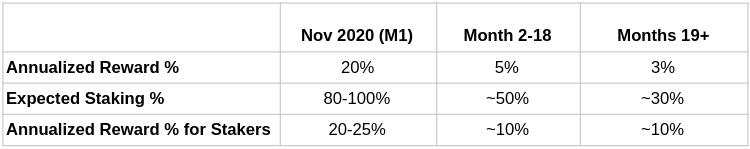

On Flow, 100% of inflation is distributed to stakers – meaning holders of Flow will not be diluted as long as you are actively participating. In other words, new issuance is only distributed to validators staking and performing work to support the network, or delegators directly pledging their tokens against a specific validator’s dependability. While the community will ultimately be able to adjust reward parameters, an indicative inflation schedule is shown below.

The expected staking percentage is expected to decline over time as additional use cases become available, such as infused tokens. As this occurs, Flow is designed to minimize inflation and will optimize this against providing sufficient rewards for validators.

Over the long term, Flow is designed to limit new issuance of FLOW tokens as much as possible, with a total target pool established to pay to validators consisting of i) transaction fees paid to the network; and ii) new FLOW tokens instantiated. New issuance is offset by the fees collected by the network. Because of this, high levels of transaction throughput results in lower annual issuance.

400 million FLOW tokens have been set aside for ecosystem development to help bootstrap network effects and ensure a diverse and accessible community over the long term.

Recipients of Flow ecosystem support include entrepreneurial support organizations, non-profits, and academic institutions including Berkeley, Purdue, UC Davis, and Rochester Institute of Technology. These groups share FLOW credits with their communities and broaden accessibility.

Flow ecosystem development programs are designed to reward the efforts of a decentralized community building sustainable value – not speculation. As a result, FLOW tokens distributed through these programs in the first year will be subject to lockups and transfer restrictions that expire no sooner than the first unlock date applied to early backers and the team. Ecosystem development programs also include token leases for purposes of staking, allowing reputable community organizations to participate in the network and earn rewards.

Flow has been developed and brought to market by one of the most innovative and interdisciplinary teams in the world.

The development team pool unlocks over 3 years, ensuring all stakeholders are aligned.

As the corporate entity that funded the development of the Flow technology, Dapper Labs has been allocated 250 million tokens which it intends to hold as part of its long-term treasury.

Subscribe to stay tuned for latest updates.